DenisAmbrosov

New Member

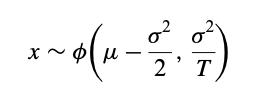

Hello! May someone explain how to get the distribution like below. We cancel out T in the mean by dividing by 1/t but we also should cancel the T out in the variance part but after canceling we still have sigma/T but why not just sigma. So we have (mu - sigma2 / 2) * T, sigma2 * T and all this divided by T then T should cancel out but at the end in the distribution we have mu - sigma2 / 2 , sigma / T. Why is it so? Explain,please